Background

- AML3D Limited (AML3D or the Company) provides contract manufacturing services to the aerospace, marine, defence, oil and gas, mining, and general manufacturing sectors in Australia, Singapore and the United States

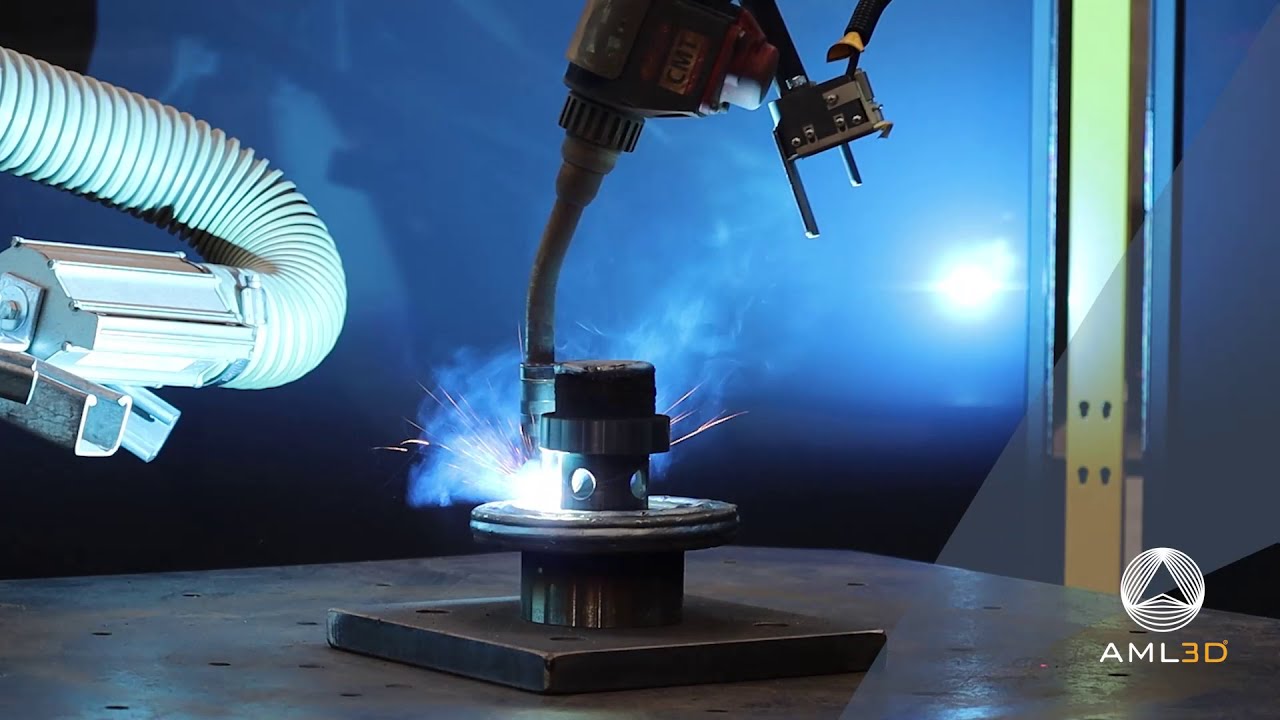

- The company produces metal components and structures through automated wire-fed 3D printing technology

- AML3D engaged AE as an independent corporate advisor on its initial public offering to increase production capacity and allow the Company to service significant new interest from customers without compromising their ability to deliver to current clients

Our role

- Assisting with investor presentations to demonstrate the opportunity, providing investors with a strong understanding of the business and maximising investor perception

- Drafting prospectus

- Providing guidance on valuation and share pricing

- Assist in meeting with potential investors and coordination of IPO counterparties

- Manage process alongside the Company in determining lead manager / underwriter

- Assisting management through the process to ensure the Company’s short and long-term goals are met

Outcomes

- AML3D successfully completed its $9,000,000 IPO in April 2020

- The company closed the offer on March 27, 2020 oversubscribed, demonstrating the exceptional interest and support gathering for AML3D’s IPO process and product

- The funds will be used for the expansion of AML3D’s operations and production capacity, including establishing the Singapore Contract Manufacturing Centre and expanding the Adelaide Contract Manufacturing Centre